The COVID-19 pandemic brought about a rapid increase in the popularity of remote work, transforming it from a growing trend to a widespread reality. This shift has not only changed the way businesses operate but has also opened up new avenues for global talent acquisition. As a result, the gig economy has experienced substantial growth, offering lucrative foreign currency earning opportunities for remote workers. For South Africans, leveraging the advantages of earning foreign currency brings a host of benefits that can help navigate economic challenges and secure financial stability.

The Gig Economy in South Africa

South Africa is one country that has seen a surge in demand for its resources due to the wealth of talent, knowledge, and skills available at relatively low cost, compared to other international options, making it an attractive option for businesses looking to reduce costs. Online platforms have emerged as intermediaries, connecting businesses with freelancers and independent contractors, facilitating project-based collaborations across borders. This has created a thriving ecosystem where individuals can leverage their skills and expertise to secure opportunities from anywhere in the world. According to a recent Investec report, “What is the gig economy and why is it growing?”, South Africa has an estimated 3.9 million giggers.

The Upside of Earning Foreign Currency

One of the significant advantages of earning foreign currency is the protection it offers against local economic instability. South Africa has faced its share of economic fluctuations, but by earning in foreign currencies such as USD, GBP, or EUR, individuals can mitigate the impact of local economic uncertainties. Foreign currencies provide a hedge against inflation, currency depreciation, and economic downturns, ensuring the preservation of hard-earned cash.

Moreover, diversifying income streams through foreign currency earnings decreases dependence on a single currency or market. Having multiple income sources in different currencies provides a buffer against potential losses and helps maintain a stable financial position. This strategic approach empowers South Africans to navigate economic uncertainties, as their income becomes less reliant on the performance of the local economy alone.

On the flip side, receiving payments from overseas in South Africa does pose its fair share of challenges. For remote workers, dealing with foreign currency payments can be quite a hassle due to accessibility to foreign currency accounts and the high fees charged by banks and remittance companies.

The Solution: Earning Globally, Managing Locally

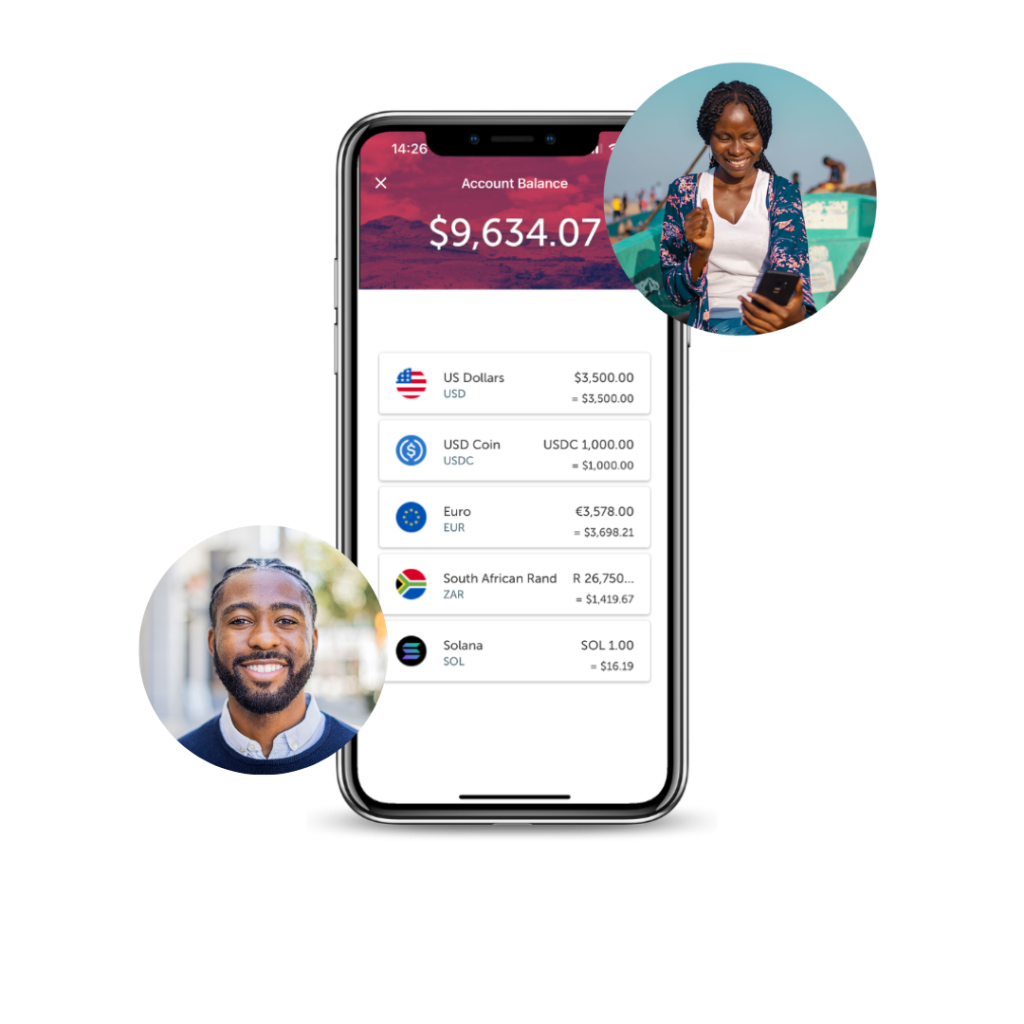

Fortunately, fintech platforms like Be Mobile Africa have stepped in to provide convenient and cost-effective solutions for remote workers to receive foreign currency payments from international companies. With Be Mobile Africa, you can say goodbye to high fees and complicated processes. Simply download the free app from both Google Play and the App Store, and experience the ease and efficiency of receiving your foreign currency payments hassle-free.

What you get with a Be Mobile Africa account

- Remote account opening from anywhere

- No monthly account fee

- Free money transfers between Be users

- Access to foreign currency accounts in USD, GBP, EUR, CAD, ZAR and 17 other emerging market currencies

- Exchange foreign currencies at low fees

Who can sign up?

Anyone older than 18 can sign up for a Be Mobile Africa account.

What do I need to sign up?

A compatible phone, the Be Mobile Africa app and your government issued ID.