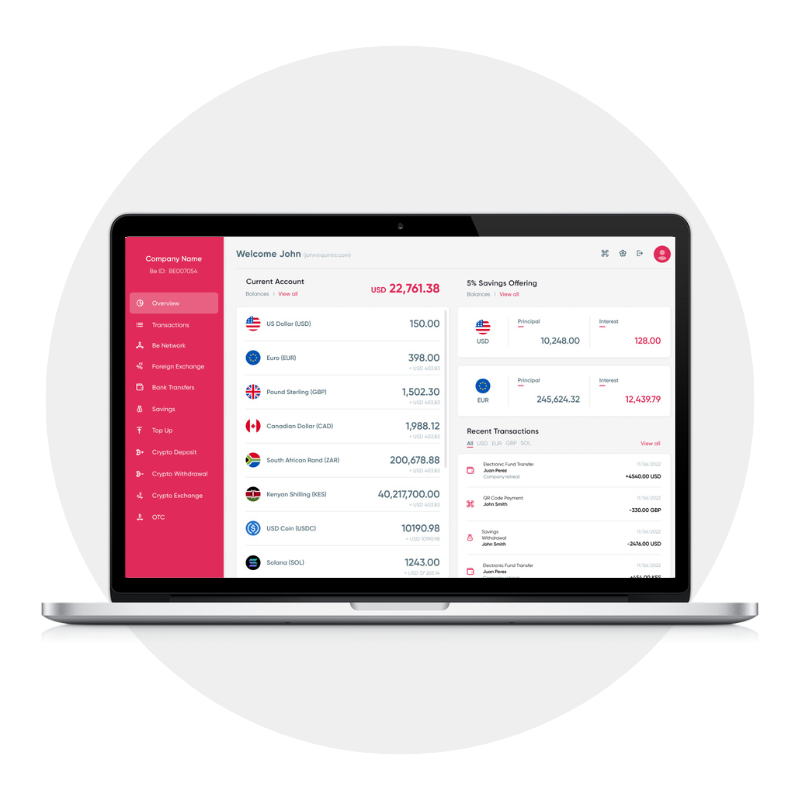

Open a global multi-currency business account

Bank across borders, make and take payments in over 20 currencies.

Get global with a business account

Receive, hold and send funds globally and in real-time

With Be Mobile Africa, business customers can transact in USD, EUR, GBP, CAD and 17 emerging market currencies.

Apply and open an account in 48 hours.

Make and take payments in over 20 currencies

Low FX rates

Get preferential rates

Exchange currencies with competitive FX rates.

Cross border money transfers

Cross border B2B payments at low, competitive FX rates

– Free and real-time money transfers between Be customers

– Live settlement with funds available in seconds

– Send or receive international electronic payments across the SWIFT and SEPA networks.

Crypto services

Buy, hold and sell crypto

Buy, sell, hold, and convert crypto currencies such as Bitcoin, Ethereum, Solana, as well as USD stablecoins such as USDC and USDT.

Get paid by customers and pay suppliers and vendors with crypto.

Serious Savings

Save at 5% interest per annum

Earn 5% on USD and EUR

Invest USD or EUR in a Be Mobile savings account and you’ll earn 5% per annum.

No long lock up

A lot of investment products lock up your funds for 12 months. Be Mobile doesn’t. You can withdraw your principal and the interest you’ve earned after 90 days if you want.

Start with $100

Be Mobile is designed to be accessible. With a deposit as little as 100 USD (or the equivalent) you can benefit from the power of the blockchain to make more from your money.

Interest Plus

Have any of 22 currencies indexed on USD. We convert the savings into USD which then gets invested. So you make 5% on the USD plus any appreciation on the currency exchange over the investment time frame.

Easy Payments

Peer to Peer

Make payments to people in 35 countries in your choice of 22 currencies. It’s instant and free between Be users.

Pay Bills

Use Be to pay bills and businesses no matter who they bank with or where they are.

Secure Swaps

Be holds deposits securely until both parts are in, then completes the swap.

Coming soon: Visa Card

Pay with Visa cards around the world in multi-currencies, with no fee on foreign exchange.

Remittances

Send money easily to anyone, using their phone or bank account number at a fraction of the normal cost.

Wire Transfers

Send or receive international electronic payments across the SWIFT, SEPA, and Interact networks.

E-commerce

Merchants can accept and hold payments in 22 currencies. With only a 1% charge, no set up costs, monthly fees or minimum balance.

Coming soon: Pay Widget

Merchants can accept payment using the Pay with Be Mobile Africa widget by simply adding a line of code to their site.

Any questions?

Opening a business account and have questions? We’ve got you!

Apply online by submitting the required company documents. KYC document requirements:

- Certificate of Incorporation

- Articles of Incorporation

- Business Registration

- Business Proof of Address (less than 3 months old)

- Shareholder Register

- Passport of all Shareholders/Ultimate Beneficial Owners holding >25% of the issued and outstanding shares of the corporation and passport of all signatories to this application

- Shareholders/Ultimate Beneficial Owners Proof of Address (less than 3 months old)

If all the required business documents are submitted, accounts are usually validated within 48 business hours.

Please email support@bemobileafrica.com.